1. Introduction: The Escalating Cost of Populism

Reference Article: Sops for women now a norm, 12 states’ outgo to be Rs. 1.7 Lakh Cr., or 0.5% of GDP (TNN, Nov 05, 2025)

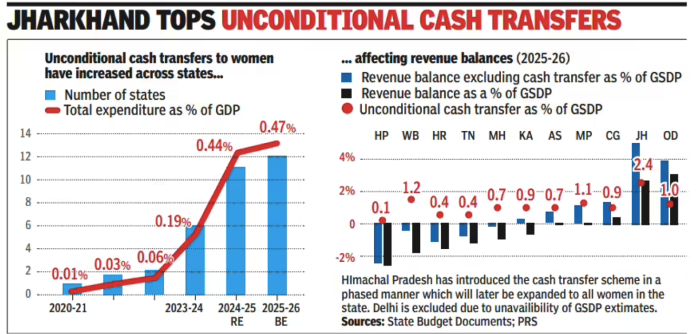

The growing trend of direct cash transfers and consumption subsidies, often termed “sops,” has become a dominant electoral strategy in India, leading to a significant and rapidly increasing burden on state finances. This analysis evaluates the adverse fiscal impact of this trend—specifically through Unconditional Cash Transfers (UCTs)—and proposes a structural solution to safeguard the nation’s long-term Gross Domestic Product (GDP) value. The projected cumulative annual outgo of approximately ₹1.68 lakh crore across just 12 states highlights a systemic challenge that risks crowding out productive investments and undermining macro-economic stability.

2. Analysis of Adverse Fiscal Impact

2.1 Compromising Revenue Balances and Creating Deficits

The most immediate consequence of UCT proliferation is the strain on state budgets, often resulting in fiscal deterioration. Schemes across various states, predominantly targeting women, demonstrate this critical shift:

- Karnataka’s Gruha Lakshmi: Provides ₹2,000 monthly, a substantial outflow that contributed to the state moving from a revenue surplus to a projected revenue deficit.

- Madhya Pradesh’s Ladli Behna Yojana: Offers ₹1,250 monthly, significantly narrowing the state’s traditional revenue surplus.

- Tamil Nadu’s Kalaignar Magalir Urimai Thittam: Allocates ₹1,000 monthly, contributing to the state’s high debt-to-GDP ratio.

- Odisha’s Subhadra Scheme: Recently announced, offering an annual transfer of ₹10,000, signaling the continued adoption of this spending pattern even in fiscally conservative states.

- See table appended below for more …

A state running a persistent revenue deficit means current, recurring consumption expenditure is being financed by new debt, which reduces resources available for future generations and compromises fiscal sustainability. Furthermore, broader consumption subsidies, such as the 300 Units of Free Power offered in states like Punjab and Delhi, drain state resources and often lead to accumulated debt in power distribution companies (Discoms), effectively converting explicit subsidies into hidden public debt.

2.2 Crowding Out Productive Capital Expenditure (CAPEX)

The diversion of massive fiscal resources towards consumption transfers directly compromises funding for vital Capital Expenditure (CAPEX)—investments in infrastructure, education, health, and skill development. These long-term, multiplier-effect investments are essential for maximizing sustained national growth and GDP value.

- The allocation of ₹1.68 lakh crore (0.5% of GDP) to consumption sops reduces the financial headroom for growth-enhancing projects.

- Large, one-time shocks like Farm Loan Waivers force states into heavy borrowing, immediately curtailing the ability to fund CAPEX in subsequent years.

- By prioritizing immediate, consumption-driven transfers, political decisions sacrifice the long-term, compounding economic benefits derived from building infrastructure or improving human capital, thereby causing structural damage to the country’s growth trajectory.

2.3 Policy Instability and Unsustainability

The cyclical nature of these populist promises—often increased or initiated just before elections—creates an environment of policy instability. The political need to constantly raise payouts (as seen in Jharkhand increasing its women’s transfer scheme from ₹1,000 to ₹2,500) overrides sound fiscal management. This uncertainty makes long-term planning difficult for state governments and sends a negative signal to private investors, further suppressing sustainable economic activity.

3. Proposed Solution: The Surakshit Bharat Abhiyan (SBA)

To counter the popularistic political cycle and safeguard the nation’s financial future, a structural national initiative, the Surakshit Bharat Abhiyan (Safe India Mission), is proposed. This mission would institutionalize fiscal prudence with three core mechanisms aimed at maximizing GDP value:

3.1 Mandatory Fiscal Impact Assessment (M-FIA)

Any new welfare scheme exceeding a predetermined expenditure threshold (e.g., 0.1% of GSDP) must undergo a Mandatory Fiscal Impact Assessment (M-FIA).

- Mechanism: An independent, non-partisan Fiscal Council would conduct the M-FIA.

- Output: The assessment must publicly detail the scheme’s net revenue cost, its exact effect on the state’s revenue balance (surplus/deficit), and its opportunity cost—the specific productive CAPEX investments being displaced. This ensures transparency and holds governments accountable for the true long-term fiscal trade-offs of short-term political benefits.

3.2 Conditional Transfer Mandate (CTM)

The SBA would establish a national framework mandating a strong preference for Conditional Cash Transfers (CCTs) over Unconditional Cash Transfers (UCTs) for all new major schemes.

- Mechanism: Financial aid must be linked to measurable social or economic outcomes (e.g., school attendance, health check-ups, or participation in skill training, similar to the model used in the Lakhpati Didi Scheme).

- Goal: This ensures that welfare spending generates a human capital multiplier effect, preventing the fiscal outflow from being a pure consumption drain and instead channeling funds towards productivity enhancement.

3.3 Fiscal Ceiling and Automatic Debt Enforcement

A statutory, non-negotiable ceiling must be established, limiting the total cumulative expenditure on non-merit, pure consumption subsidies to a sustainable percentage of GSDP, linked to the state’s total debt-to-GSDP ratio.

- Mechanism: Breaching this predetermined fiscal ceiling would automatically trigger mandatory review and curtailment procedures enforced by an inter-state fiscal body under the Abhiyan’s purview.

- Goal: This provides a hard guardrail against fiscal indiscipline, ensuring that political promises are fiscally responsible and do not compromise the nation’s financial sovereignty and long-term economic health.

4. Conclusion

The current trajectory of consumption subsidies poses a significant threat to India’s fiscal health and long-term growth prospects. By institutionalizing prudence through the Surakshit Bharat Abhiyan’s frameworks—mandatory fiscal impact assessment, conditional transfers, and hard fiscal ceilings—the nation can balance necessary welfare support with the imperative for investment-led growth, ensuring that the GDP value is preserved and maximized for future generations.

| Scheme Name | State | Target Group | Key Benefit/Sop | Fiscal Context / Impact |

| Gruha Lakshmi | Karnataka | Women Head of Family | ₹2,000 monthly unconditional cash transfer (UCT). | One of the most significant UCTs that contributes substantially to Karnataka’s reported shift from a revenue surplus to a deficit. |

| Ladli Behna Yojana | Madhya Pradesh | Women aged 21-60 | ₹1,250 (recently increased from ₹1,000) monthly cash transfer. | A major factor in the state’s expenditure, noted to reduce its revenue surplus from 1.1% of GSDP to a marginal 0.4%. |

| Kalaignar Magalir Urimai Thittam | Tamil Nadu | Eligible Women (above 21) | ₹1,000 monthly allowance. | Contributes to the state’s high debt-to-GDP ratio, fueling concerns about extensive social welfare programs. |

| Orunodoi Scheme | Assam | Marginalized Families (woman head) | ₹1,250 monthly assistance. | An earlier pioneer of the widespread UCT trend, its allocation was increased by 31% in 2025 (as noted in the reference article). |

| Subhadra Scheme | Odisha | Women aged 21-60 | Annual transfer of ₹10,000 (in two installments). | A recently announced scheme (Sep 2024), demonstrating the spread of such UCTs across new states, further increasing the collective national burden. |

| 300 Units of Free Power | Punjab / Delhi (similar) | Households (Universal/Near-Universal) | Free electricity up to a set limit (e.g., 300 units). | Power subsidies are one of the largest drains on state budgets, often leading to huge accumulated debt in power distribution companies (Discoms). Punjab is noted as having one of the highest subsidy burdens. |

| Farm Loan Waivers | Multiple States (e.g., Andhra Pradesh, Maharashtra) | Farmers | Complete waiver of outstanding loans. | While not a recurring cash transfer, these are massive, one-time fiscal shocks that force states to borrow heavily, drastically curtailing the fiscal space for capital expenditure in subsequent years. |

Disclaimer and Academic Use Statement

This document is provided for academic and analytical purposes only.

- Plagiarism: The content of this analysis is an original synthesis and critique based on publicly available data, news reports, and economic analyses. Any direct quotes or data points are sourced from the context provided (as indicated in the ‘Reference Article’ below). Students must ensure independent analysis and citation in their own work.

- Data Privacy & Authenticity: The information regarding government schemes and fiscal statistics is derived from open-source intelligence (OSINT) based on available reports and press coverage. While every effort has been made to ensure accuracy and authenticity at the time of compilation, specific fiscal figures and political contexts are subject to rapid change and independent verification is advised.

- Information Source (OPINT): The analysis relies on Open-Source Public Information, interpretations, and synthesized public-domain knowledge.