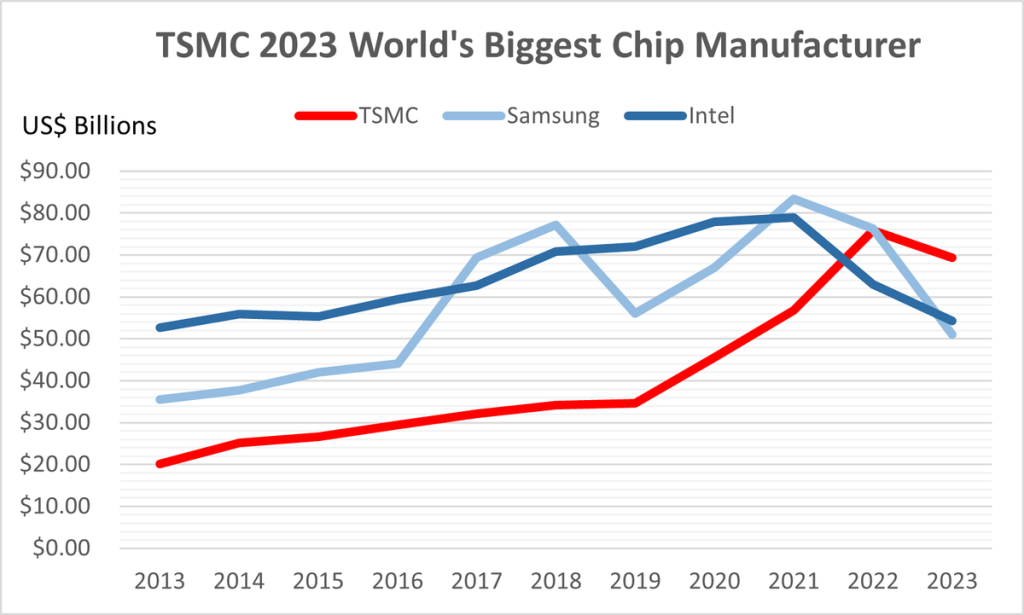

TSMC has been the world’s number one contract maker of chips for years, but its earnings have long been significantly below those of Intel and other leading memory makers. However, a lot has changed in recent years, and in 2023, TSMC’s revenue exceeded that of Intel and Samsung, as observed by Dan Nystedt, a Taiwan-based analyst. TSMC also leads in operating profit, showing that the company continues to rake in cash as the world’s foundry.

Nystedt compiled the numbers from calendar-year revenue figures, not fiscal-year performance. Also, it’s important to note that these figures also include revenue from other sources within each company and aren’t comprised solely of income from manufacturing silicon.

As Nystedt notes, TSMC is now the largest chip semiconductor company in the world of any kind. Despite a challenging year, TSMC earned $69.3 billion in 2023, significantly more than Intel, whose revenue dropped to $54.23 billion, and Samsung, which earned $50.99 billion. Based on fourth-quarter guidance, Nvidia could end 2023 with revenue of over $58 billion, the analyst estimates, so it will outperform both Intel and Samsung, but not TSMC.

TSMC is a newcomer to this top spot, as historically, it has lagged Intel and Samsung despite being the world’s largest foundry. TSMC’s revenue began to increase rapidly in 2020, largely because of the coronavirus pandemic and increased demand for everything digital, including PCs and game consoles. And since modern production nodes are generally expensive to use, TSMC’s revenues are indeed increasing. Since TSMC has pulled ahead of Intel and Samsung in terms of process technologies, it can enjoy selling its services at a hefty premium, which definitely helps with revenue.

Intel led the semiconductor industry for decades, from 1992, when it dethroned NEC, to 2017, when Samsung outperformed it by a significant margin. But Samsung’s semiconductor revenue depends on 3D NAND and DRAM memory prices, whereas Intel’s revenue largely consists of logic products, such as CPUs for client and data center applications. Additionally, at this point, many of Intel’s products are made by TSMC.

It is noteworthy that TSMC does not develop its own processors but instead makes some of the world’s most advanced chips for fabless developers, such as AMD, Apple, Nvidia, Qualcomm, and many others. Apparently, this formula is working very well, at least for now. What remains to be seen is whether Intel will manage to reclaim the crown years down the road when its Intel Foundry Services division starts taking a piece of TSMC’s market by getting orders to make chips using its leading-edge process technology.